SRI & ESG

Emergence provides

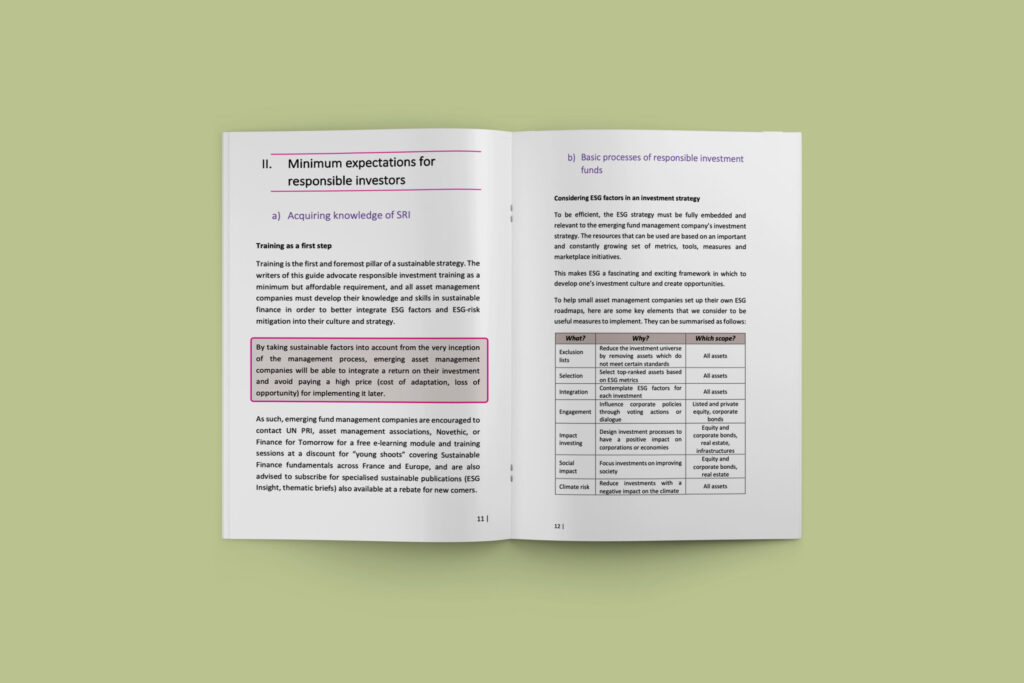

Its Practical Guide on Socially Responsible Investment (SRI), a compilation of the essential prerequisites for implementing an SRI policy consistent with the governance of each independent asset management company and with the approach of their investment strategies.

In 2025, Emergence updates its ESG policy to incorporate new measures aimed at addressing biodiversity preservation challenges. This document sets out the normative exclusions and the climate policy applicable to all investments made by the equity sub-funds of the Sicav. It also outlines the expected levels of CSR commitment and ESG criteria integration among partner asset management companies

The ESG reporting framework is a list of the basic extra-financial indicators to be reported by asset management companies accelerated or aiming at being accelerated by Emergence. It is a new tool for tracking progress over time in terms of responsible and sustainable investment practices and strategies.

EMERGENCE’s ESG policy is a unique achievement that brings together the shared expectations of institutional investors who are members of the SICAV.

Using best practices, it sets an ambitious and flexible framework based on an incentive for progress, and aims to enable entrepreneurial fund managers to adapt to investors’ growing demands. It also reflects the desire to strengthen extra-financial status as an investment criterion within the SICAV and to make a concrete contribution to the transition to a sustainable economy

Karine LEYMARIE

Karine LEYMARIE (MAIF) and Benoit DONNEN (NewAlpha AM) explain the benefits of EMERGENCE’s SRI measures for entrepreneurial asset management companies.